The financial OTW (one’s to watch) this week will be the opening of US 3Q earnings season, with many high-profile financial corporations reporting earnings throughout the week.

There will also be an important European Council meeting Thursday and Friday, one which will have important ramifications regarding UK/EU Brexit negotiations. Boris Johnson made a self-proclaimed deadline for the end of October to reach a trade deal. This timeline seems more realistic as Mr. Johnson held weekend talks with Macron and Merkel.

In terms of data releases, the US will release its CPI on Tuesday and Retail Sales and Industrial Production on Thursday (both for September).

For central banks, two G20 decisions expected next week will be from The Bank Indonesia and the Bank of Korea. Experts believe rates for both banks will remain unchanged.

Back to the big ticket items, this week will kickstart earnings season, headed by Johnson & Johnson, JPMorgan Chase, Citigroup and BlackRock on Tuesday.

On Wednesday, we will hear from UnitedHealth Group, Bank of America, ASML, Wells Fargo, Goldman Sachs and United Airlines.

On Thursday, we get releases from Morgan Stanley and Walgreens Boots Alliance.

Summary of Earnings for week of Oct.12/2020:

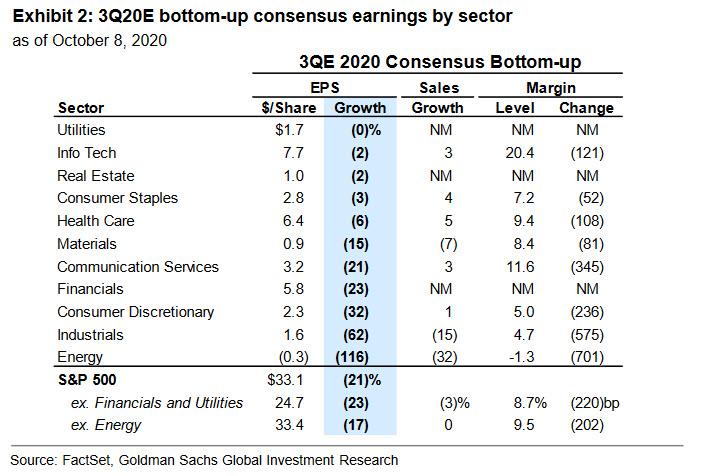

As we reported last night (from Zerohedge.com), Kostin of Goldman wrote that the consequences of the semi-frozen economy will be visible in 3Q results: consensus expects 3Q S&P 500 EPS will decline by 21% on a year/year basis, following a 32% drop in 2Q and a 15% fall in 1Q.

3Q earnings consensus by sector:

Here is a day-by-day summary of key events this week:

Monday October 12

- Data: Japan September PPI, August core machine orders

- Central Banks: BoE’s Bailey and Haskel speak

- Other: IMF/World Bank Annual meetings begin, bond market holiday in the US and Canada

Tuesday October 13

- Data: China September trade balance, UK August employment, Germany final September CPI, October ZEW survey, US September CPI, NFIB small business optimism index

- Central Banks: Bank Indonesia monetary policy decision

- Earnings: Johnson & Johnson, JPMorgan Chase, Citigroup, BlackRock

- Other: IMF release latest World Economic Outlook

Wednesday October 14

- Data: Japan final August industrial production, Euro Area August industrial production, US weekly MBA mortgage applications, September PPI

- Central Banks: Bank of Korea monetary policy decision, Fed’s Clarida, Quarles, Kaplan, ECB’s Lane, Villeroy and BoE’s Haldane speak

- Earnings: UnitedHealth Group, Bank of America, ASML, Wells Fargo, Goldman Sachs, United Airlines

Thursday October 15

- Data: China September CPI, PPI, Japan August Tertiary Industry Index, France final September CPI, US weekly initial jobless claims, October Empire State manufacturing survey, Philadelphia Fed business outlook, September import price index

- Central Banks: Fed’s Quarles, Bostic, Kashkari, BoE’s Cunliffe speak

- Earnings: Morgan Stanley, Walgreen Boots Alliance

- Politics: European Council meeting begins

Friday October 16

- Data: EU27 September new car registrations, Italy final September CPI, Euro Area final September CPI, August trade balance, Canada August manufacturing sales, US September retail sales, industrial production, capacity utilisation, August business inventories, foreign net transactions, preliminary October University of Michigan sentiment

- Earnings: Honeywell International, BNY Mellon

- Politics: European Council concludes\

Works Cited:

https://www.zerohedge.com/markets/key-events-week-earnings-season-begins-cpi-and-retail-sales

https://www.zerohedge.com/markets/q3-earnings-preview-its-faamgs-vs-everyone-else

Deutsche Bank

Bank of America

Goldman Sachs