After announcing its highly-touted IPO back in August, retail investors across China had put in a record bid of $3 trillion in China’s Ant group (about equivalent to British GDP), the worlds highest valued Fintech and “unicorn” company. Though, investors both seasoned and amateur were stunned after regulators abruptly suspended what would have been the world’s largest stock market debut.

Beijing blocked the fintech giant’s $37 billion listing on Tuesday, thwarting its debut in Hong Kong and Shanghai scheduled for Thursday.

The suspension followed a Monday meeting between China’s financial regulators and Ant executives, including Ma, who were told the company’s lucrative online lending business would face tighter scrutiny (Reuters).

Retail investors from students and taxi drivers to institutional investors who had used their savings and borrowed heavily from banks and brokerages to fund share purchases, were left empty-handed.

Jack Ma, founder of Alibaba, the parent company of Ant, an outspoken critique of China’s financial system and has questioned global regulatory models at a high-profile conference last month, calling banks “pawn shops”, saying that China is still a “youth” and needs more innovation to build an ecosystem for the healthy development of the local industry.

These comments summoned Ma to a “meeting” in Beijing, to outline an array of concerns and new regulations for Ant. At that point, the Ant IPO was abruptly halted.

Ant’s case is eerily similar to Evergrande, whose bond trading was halted back in late September by the Shanghai stock exchange citing “abnormal fluctuations”. The Ant escapade shows that even with a valuation of nearly half a trillion dollars, it’s company can be crippled overnight.

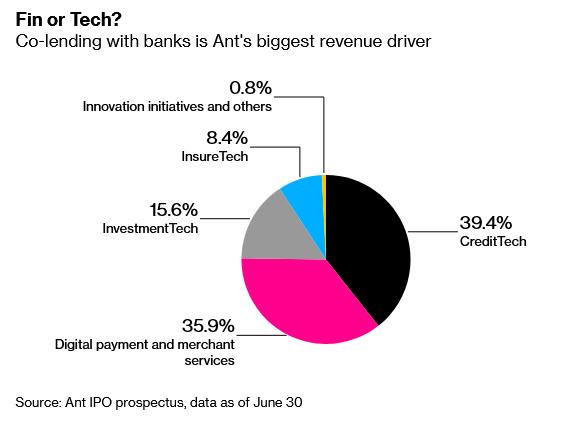

Though, the shutdown comes as China aims to bring about more safety to its financial system, as bad loans begin to pile and the economy continues to be in a fragile state due to the COVID-19 pandemic. Ant’s biggest business is online lending via CreditTech, as the company has underwritten about 1.7 trillion yuan ($253 billion) in consumer loans and 422 billion yuan in small business loans for about 100 banks and other financial institutions.

What perhaps the Chinese government was focused on was the unsecured loans written by Ant. According to Bloomberg, Ant also helped provide unsecured loans to about 500 million people over the past year through two of its platforms: Huabei (Just Spend) and Jiebei (Just Lend). The former focuses on quick consumer loans for small purchases, while the latter finances everything from travel to education. Ant typically charges annualized interest rates of about 15% to consumers, well above prevailing rates. Its more than 20 million small business borrowers pay an average lending rate of about 11%, almost double the average 5.94% small borrowers can get from banks.

Ant may have been engaging in suspicious, even predatory, lending practices.

The full scope of China’s plans for Ant are unclear, and it’s possible that lenders will continue to work with the company once it complies with regulators’ requests.

Jack Ma and the mom-and-pop investors who had placed orders for shares will continue to hold their breath.

Works Cited:

https://www.zerohedge.com/markets/ant-crackdown-beijing-puts-chinas-richest-man-squarely-its-sights

https://www.ft.com/content/f655ba5f-7a69-4927-b2b0-355dfb666398