Heralded Morgan Stanley Trader, Michael Wilson, has been ahead of the market curve since March. He correctly traversed the March crisis maintaining a bullish outlook, then remaining bullish until just over a month ago, when he warned “brace for a very difficult trading environment over the next five weeks“, a forewarning of the September tech dump.

Recently, Wilson correctly predicted that US stocks were due for a second 10% correction as “investors were a bit too complacent on the uncertainty surrounding the election outcome, complemented with unlikely passage of any fiscal stimulus before the election and ongoing second wave of COVID-19”. Since then, the S&P 500 has fallen 9% while the Nasdaq lost 10%.

Today, prior to Pfizer’s announcement that its vaccine data may be 90 per cent effective at preventing COVID-19, Wilson was again correct about the markets path.

On the topic of Pfizer’s news, Dr. Anthony Fauci, the director of the National Institute of Allergy and Infectious Diseases, called the trial results “extraordinary” and said Pfizer’s success bodes well for a similar vaccine being developed by U.S. firm Moderna.

In his latest note (before Pfizer’s news), Wilson writes that he has remained a “committed bull” based on his thesis since late March that “bear markets end with recessions as new bull markets begin.” He adds, “when bull markets simultaneously begin with a new economic cycle, they typically last for years, not months or quarters. As such, we believe this bull market has a long way to run both in time and price. Our calls for a 10% correction in August and then again in October were under the guise that we needed a pause/consolidation of the extraordinary gains during the first stage of this new economic cycle and bull market.”

He quantifies his bullish view by saying that his “S&P 500 range of 3150-3550 is based on both technical and fundamental analysis“, Although, with the current S&P level above 3600, he will probably have to reassess this range.

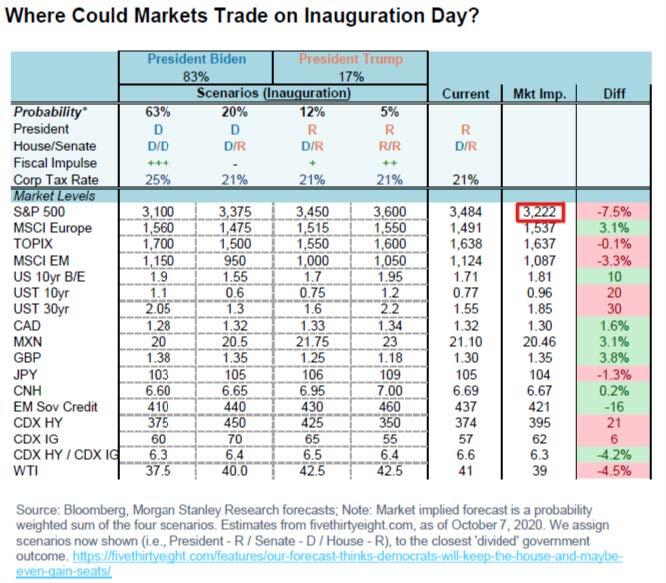

Potential market movements on Inauguration Day

So, what will happen next?

Wilson writes that there is still much uncertainty regarding the US election as well as the final two senate seats up for grabs.

“Aspects of the actual election result remain unclear: “While it appears Joe Biden has the required electoral college votes to be the next President of the United States, this outcome is being litigated by President Trump, a process that could drag out for weeks even if it doesn’t change the outcome. More importantly for markets, the Senate now stands at 50 Republican and 48 Democrat seats and the uncertainty as to the final 2 seats will have to wait until the runoff elections in Georgia begin on January 5th.”

Wilson adds, “when all the dust settles, we should have a Democrat President with a Republican Senate and a Democrat House”. Wilson also notes that at current prices, a divided government outcome appears fairly priced now (whatever merit that holds). Furthermore, it is worth rooting that we won’t know the official outcome for another 8 weeks.

Wilson concludes with ,“investors (need to) keep their head on a swivel, as this market likely has a few more cheap shots in it before year end.“

However, Wilson mainly avoided speaking of any current COVID-related second wave risks, mentioning that “Europe has reacted to this second wave with aggressive lockdowns and the US may do the same thing in some states as case counts rise. Such a risk is not priced at current levels, in our view. This is likely due to the fact that even before the Pfizer news, markets have largely ignored any second wave concerns as they are convinced a vaccine will become widely available by the end of 2020 or early 2021.

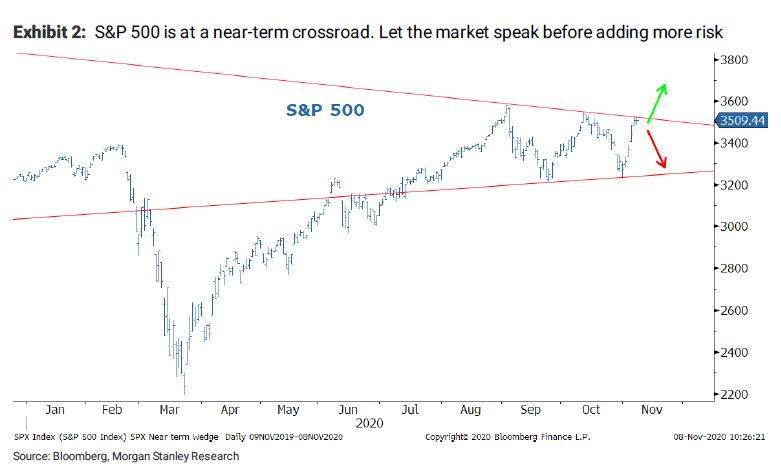

Wilson also provided a bit of technical analysis to help visualize what he has described in words.

“We highlight an interesting pattern that has now developed in the S&P 500 known as a wedge or triangle (graph below). As already noted, since peaking in early August, we have experienced two separate 10 percent corrections and recoveries. With last week’s strong rebound, the market finds itself at a critical juncture. Can it break through the top end of the wedge in Exhibit 2, or not? We make no prediction but we are leaning toward another rejection here at resistance. As such, we will let the market speak before recommending investors add more risk at prices that are far less attractive than last week.”

Wilson’s bottom line is this, “we like it when technicals line up with the fundamentals and this wedge is a perfect representation of the current situation – balancing the near-term uncertainties that remain in 2020 with the increasingly bullish outlook for 2021. As such, we continue to be bullish over the next 6-12 months but are very cognizant and disciplined about price in the short term.

On trade advice, Wilson recommends “overweighting procyclical sectors, and growth at a reasonable price (GARP) stocks while remaining careful with high quality defensive or secular growth stocks that may be overpriced for such an outcome.

With the S&P 500 now above 3600, “the upper bound” when Wilson wrote the note, with small caps soaring yet defensive and tech stock barely in the green (Zoom down 16%+), it appears that Wall Street’s fortune teller will be correct once again. . .

Works Cited: