With the US election near its critical stage, highlights for the week of Oct.26 2020 include ECB and BoJ meetings on Thursday. The ECB’s economists expect the policy stance to be left unchanged, as there’ll be more information on the status of the pandemic in December. The ECB staff will then be able to update their macroeconomic projections from which they can base their policy decisions on.

The juicy information this week comes with the first look at Q3 GDP in the US and Europe. Given the steep contractions seen in Q2, it’s quite possible that the Q3 numbers will be among the best ever quarterly performances since records began (some economists forecast an eye popping +33.8% as an example which, if realized, would be by far the strongest quarterly growth number since comparative data starts back in the 1940s).

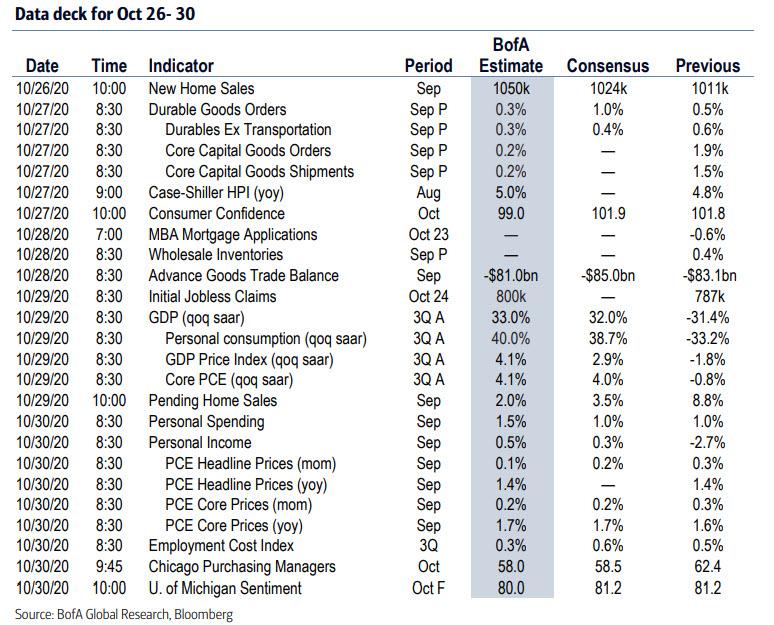

The full list is below:

Looking at the US, Goldman writes that the key economic data releases this week are the durable goods report on Tuesday, the initial Q3 GDP estimate on Thursday, and the personal income and spending and UMich consumer sentiment reports on Friday.

Now, onto the “important stuff”.

We get a major week of earnings with a whopping 184 S&P 500 companies reporting. Highlights include Microsoft, Apple, Facebook, Amazon and Alphabet (FAANGS, minus Netflix).

Here is a list of the majors reporting this week:

Here is a day-by-day schedule of the events this week (from Deutsche Bank):

Monday

- Data: Japan final August leading index, Germany October Ifo business climate indicator, US September Chicago Fed national activity index, new home sales, October Dallas Fed manufacturing index

- Earnings: SAP, Alphabet

Today, Amy Coney Barrett was sworn in to the Supreme Court, after her nomination was confirmed.

Tuesday

- Data: China September industrial profits, Euro Area September M3 money supply, US preliminary September durable goods orders, nondefence capital goods orders ex air, August FHFA house price index, October Conference Board consumer confidence, Richmond Fed manufacturing index

- Central Banks: Fed’s Kaplan speaks

- Earnings: Microsoft, Novartis, Pfizer, Merck & Co., Eli Lilly & Co, Caterpillar, HSBC, BP, 3M, AMD

Wednesday

- Data: France October consumer confidence, US weekly MBA mortgage applications, preliminary September wholesale inventories, Japan September retail sales (23:50 UK time)

- Central Banks: Monetary policy decisions from the Bank of Canada and the Central Bank of Brazil

- Earnings: Visa, Mastercard, United Parcel Service, Amgen, Boeing, GlaxoSmithKline, Ford Motor Company, General Electric, Nomura, eBay

Thursday

- Data: Germany October unemployment change, preliminary October CPI, Italy October consumer confidence index, UK September mortgage approvals, Euro Area final October consumer confidence, October economic confidence, US weekly initial jobless claims, advance Q3 GDP, personal consumption core PCE, September pending home sales, Japan September jobless rate (23:30 UK time) and preliminary September industrial production (23:50 UK time)

- Central Banks: Monetary policy decisions from the ECB and the Bank of Japan, ECB’s Villeroy speaks

- Earnings: Apple, Amazon, Alphabet, Facebook, Comcast, Sanofi, AB InBev, American Tower, Starbucks, Royal Dutch Shell, Volkswagen, Twitter, Credit Suisse, Lloyds Banking Group, Airbus, Shopify, Spotify, Moderna, Twitter, Starbucks, Activision/Blizzard

Friday

- Data: Japan September housing starts, France preliminary Q3 GDP, preliminary October CPI, Germany preliminary Q3 GDP, Italy preliminary September unemployment rate, preliminary October CPI, preliminary Q3 GDP, Euro Area September unemployment rate, advance Q3 GDP, October flash CPI, Canada August GDP, US September personal income, personal spending, PCE core deflator, Q3 employment cost index, October MNI Chicago PMI, final October University of Michigan sentiment

- Central Banks: ECB’s Weidmann speaks

- Earnings: Novo Nordisk, AbbVie, ExxonMobil, Charter Communications, Chevron, Total, NatWest Group

Works Cited: