Over the past 8-12 weeks, JPMorgan and other Wall Street Banks have been engaged in a comprehensive campaign to ease client fears that a Biden administration and/or “Blue Sweep” would be bad for risk assets, shifting the narrative to such outcome would be just as good for those stocks, if not better than a continuation of the status quo.

For example, when the public says, “well what about higher corporate taxes? Wall Street responds, “No worries, it will be offset by up to $7 trillion in fiscal stimulus under a joint Democratic congress.”

Well, what about a doubling in capital gains taxes? Again, Wall Street has an answer. “Not to worry, it only will affect the super-rich, and while it may hit stocks in late 2021, the dip will be quickly bought (Goldman predicts that “regardless of the election outcome, we expect roughly 10% upside to the S&P 500 by the middle of next year).

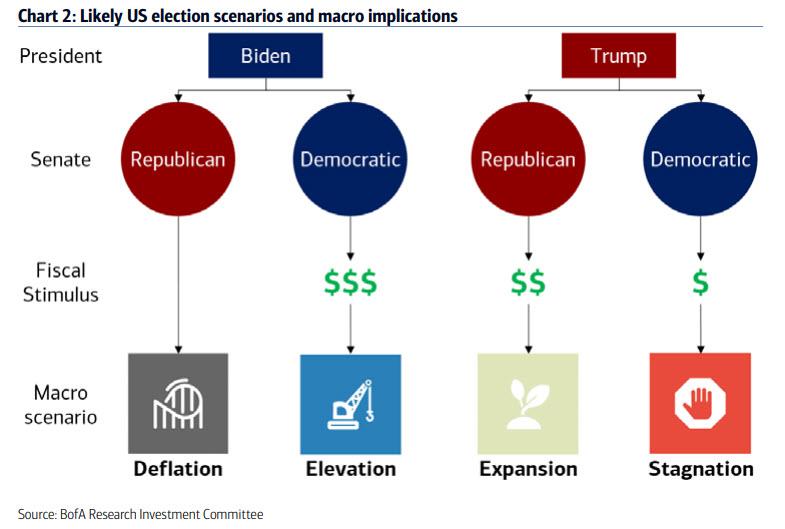

Bank of America also mapped out a road plan for all possible election results, hoping to further alleviate client concerns about possible market declines:

So, the best possible outcome is indeed a Blue sweep?

However, what if, like in 2016, polls are wrong again, and we get a Trump re-election or a mixed congress. Well, according to JPMorgan’s head of global equity strategy, Dubravko Lakos-Bujas, Wall Street has orchestrated a plan b U-turn should Trump win.

Bujas writes that he maintains a probability weighted S&P 500 price target of 3,600 for year-end, and sees “an orderly Trump victory as the most favorable outcome for equities (upside to ~3,900).”

Wall Street has spent so much time explaining just why a Blue sweep is the best possible one, yet is seems like they are trying to hedge in the case that a priced-in “blue sweep” does not happen, and traders need a fall back “parachute” in case of a Trump win and/or Congress gridlock. (Could you really expect any different?).

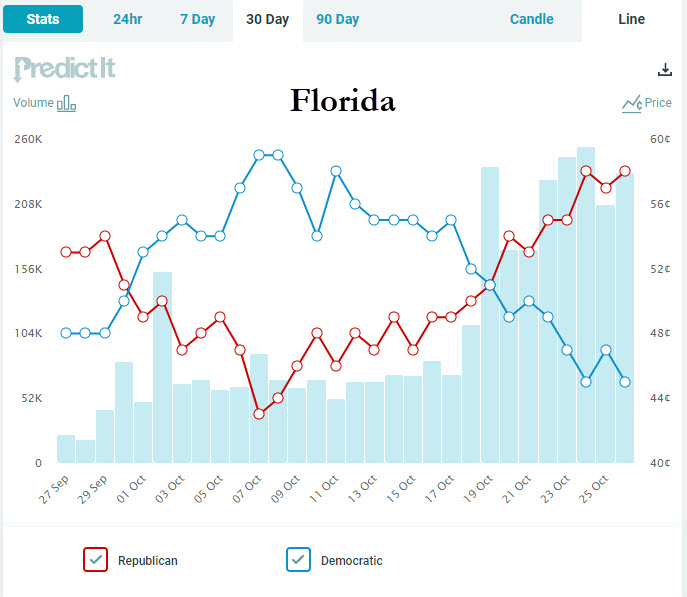

And why does JPMorgan suddenly seem to be looking over its shoulder? Bujas explains, “last week we analyzed voter registration data and their possible implication for State outcomes, while this week we analyzed Twitter sentiment on US election and compared it with the traditional polling data – they all point to a tightening race.”

PredictIt agrees, with Trump beginning to take an advantage in Florida :

JPMorgan needs to prepare a story for why a Biden victory is bullish but a Trump victory is potentially even more bullish.

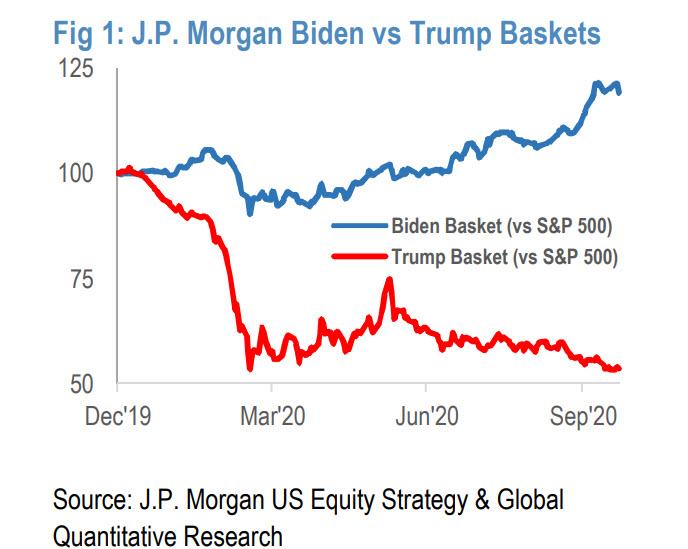

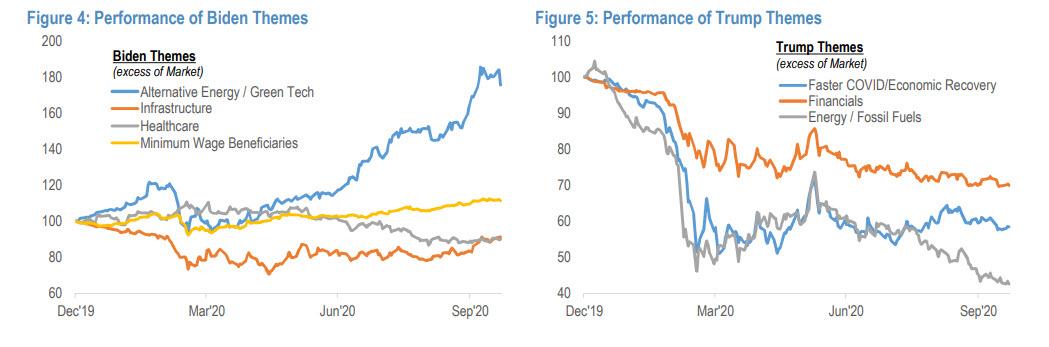

JPMorgan has also created a basket of stocks based for each party, and their actually and anticipated gains going into November.

The Biden basket is outperforming the Trump basket by 66%. The Biden basket includes alternative energy and green-tech stocks which have outperformed traditional energy and fossil fuel companies, included in the Trump basket, by 84% since June.

They added, “Deep Value, namely Energy and Financials, would likely be key beneficiaries of an ‘orderly’ Trump victory. Under a Biden scenario, we could also see profit taking from high momentum stocks, such as green techy or healthcare, especially as investors start to price in risk of higher capital gains tax.

So, all in, it looks like no matter if a Red or Blue victory, investors win.

Seems legit, right?

Works Cited: