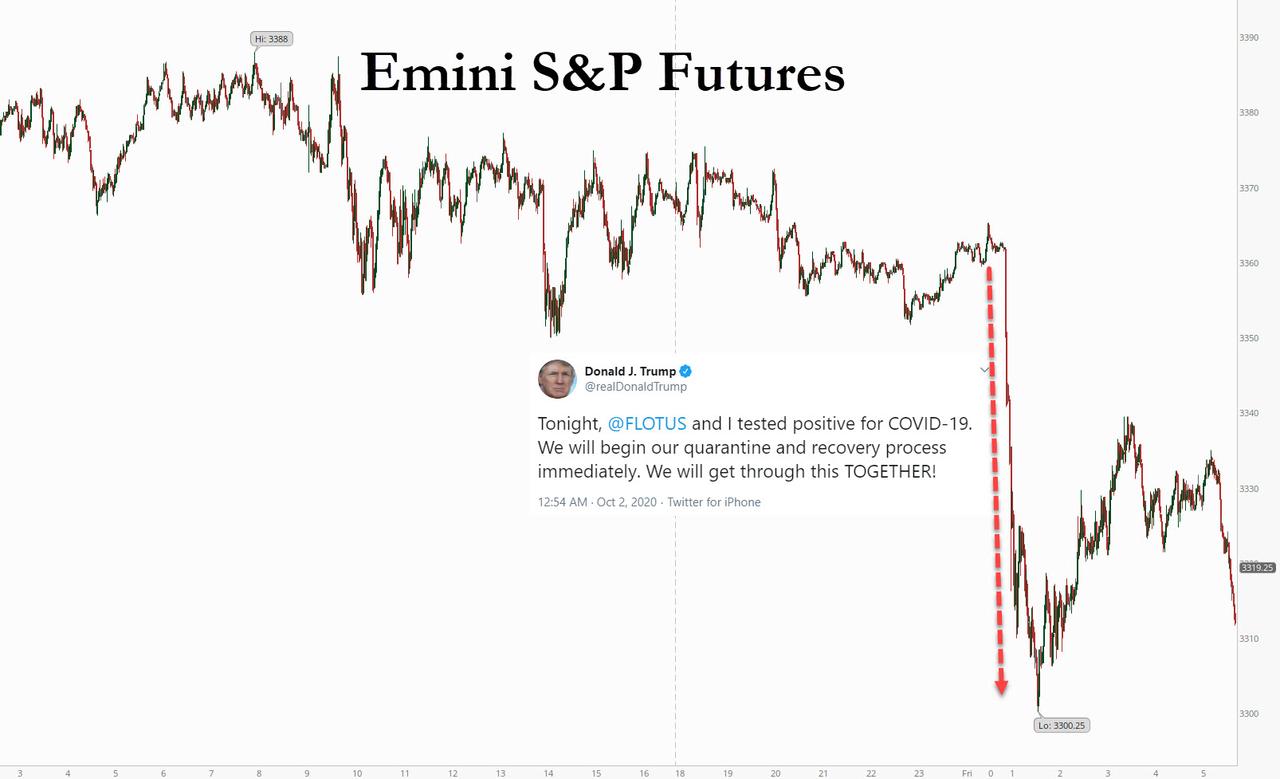

Hoping for a positive jobs report released by the BLS early Friday morning, investors and financial markets alike awoke to a real October Scare, that Donald Trump and his wife Melania, had tested positive for COVD-19.

As a result, there was immediate flush in US equity futures and global markets which saw the E-mini tumble to exactly 3,300 before rebounding modestly into the European open (Durden, 2020). The E-mini is an electronically traded futures contract, which obligates the buyer to purchase an asset or the seller to sell an asset, such as a physical commodity or a financial instrument, at a predetermined future date and price.

Prior to Trump’s revelation, US markets had been more bearish as their continues to be disagreement in Washington over a fiscal stimulus package to help the economy recover. Late Thursday night, the House passed the Democratic stimulus plan, though which the Republicans oppose.

The question now is what happens after Trumps exposure, as markets embrace for the presidential election in November (6 weeks time). How long the risk-averse moves will last depends on the extent of the infection within the White House, said Francois Savary, chief investment officer at Swiss wealth manager Prime Partners (Durden, 2020)

“We may have to wait until the end of the weekend for more clarity on the situation,” he said. “The reaction has been a bit excessive with U.S. stock futures. It doesn’t mean the U.S. administration is not able to function. It will weigh on the market today and early next week but will not induce a long-lasting correction if the infection is contained to Trump,” he added. Keep those fingers crossed as markets hope Mnuchin and Navarro (and others) remain negative.

Following the news, the U.S. dollar index rose and the safe-haven yen made its biggest jump in more than a month, reaching 104.95 (Durden, 2020).

In the commodities department, oil slumped, with Brent down 3.3% to $39.57 a barrel, its lowest level since June (Durden, 2020). Gold rose, up 0.1% at $1,906.26 per ounce (Durden, 2020).

In the political sphere, Trump’s illness prompted the White House to cancel political events on Friday, including a rally planned outside Orlando, Florida. Campaign and fundraising trips planned for the coming days, including visits to key battlegrounds including Wisconsin, Pennsylvania and Nevada, are expected to be scrapped (Durden, 2020). Biden, who despite having received a negative COVID-19 test result Friday, also cancelled numerous campaign trips. However, the VP debate scheduled for next Wednesday between Kamala Harris and Mike Pence is expected to continue.

In Europe, EU leaders reached an agreement regarding Belarus and Turkey in which they will impose sanctions on Belarus for violence and its sham election, although President Lukashenko was not included in the sanctions (Durden, 2020). The EU also warned Turkey that if it continues offshore gas exploration in Cyprus, it will face a similar reprimands.

Markets at close – Oct. 2/2020

Press Secretary Kayleigh McEnany has recently announced that President Trump will be moved to Walter Reed Medical Centre where he will work from the offices there. He was also given an “antibody cocktail”.

All of us at S&S wish Donald and his wife Melania a speedy recovery.

The weekend just got a little more uncertain, stay tuned for Monday’s open.

Works Cited:

https://www.zerohedge.com/markets/october-shock-markets-tumble-after-trump-tests-positive-covid