COVID-19’s far-reaching grasp has started to impact the price of rentals globally, one possible positive ramification of the virus.

Apartment prices in some of the richest cities in the world are starting to show the effects of an exodus out of the crowded and expensive metropolitan city in order to move to the more spacious and cost-friendly suburbs. This has been amplified by the recent major riots in many American cities that has forced people to the ‘burbs’ to seek safety.

Additionally, a slowing number of international students as a result of the pandemic, combined with a younger generation growing disinterested in paying exorbitantly high city price premiums, are both helping the demand side of the rental equation fall tenfold. Residents have also begun to negotiate lower rent, as supply is high while occupancy continues to fall.

For example, Christine Chung, who currently lives in Sydney Australia, negotiated a 9% reduction in rent for the house she lives in.

In New York, which has been known to have some of the highest rental prices in the world, are at the “cheapest they’ve been since 2013”, according to Douglas Elliman Real Estate,

The number of listings in the city have tripled from a year ago and the city’s median rent has fallen 11%. Studio rents have plunged even further.

In San Francisco, the median monthly rent for a studio fell 31% in September from a year prior, to $2,285. This far outpaced the national average of a 0.5% drop.

In S&S’s home town of Toronto, rents are down 14.5% in Q3 compared to the year prior. Properties are staying on the market for longer, as well. Even before the pandemic, S&S had an associate living in Rosedale, and it took his family nearly a year to sell their home. The average time for a property to stay on the market has risen to 26 days in August versus 14 days a year prior.

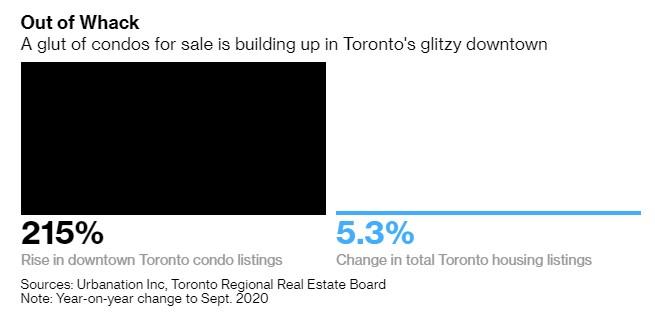

Toronto also has a massive amount of new property supply hitting the market (condos, condos, condos), with Airbnb operators moving to longer term leases and new apartment and condominium projects are completed.

Some sellers are “dumping units below market value” in anticipation of prices falling further, Bloomberg notes. An economist at Canada’s national housing agency said: “The overall housing system seems to be dividing in two. This is where risks start to appear.”

London UK is another city feeling the burn of slowing international students and executives travel plans. Rents in the city’s priciest areas are down 8.1% year-to-date through September. Many big firms are beginning to located outside of London, in cities such as Birmingham, where rents are cheaper and with more executives comfortable working from home.

In Asia, Singapore has seen similar results, with rental volumes of private units down 8% from a year prior while rents are 17% below their 2013 peak. Home sales in the country (which indicate a desire to move out of the city) are at the highest level in more than 2 years.

It seems Christine Chung is ahead of the curve, as in Sydney, the Australian capital is experiencing record high vacancy rates, which spiked to 16% in May.

Now is the time to buy, as urban experts predict cities will eventually again become hot spots for investment, with a normal resumption in the desire for life in the big city.

Christian A. Nygaard, a researcher in social economics at Swinburne University of Technology, concluded, “History tells us cities can be remarkably resilient. COVID doesn’t evaporate all the investment that has gone into the central parts of our cities.”

Time to cash in those Robinhood and Questrade gains. . .

Works Cited:

https://www.zerohedge.com/personal-finance/apartment-prices-are-crashing-major-cities-worldwide