After an abysmal Q2 which saw US GDP fall by over 30%, today, the BEA reported that in Q3 the US economy grew by 33.1%, the biggest annualized increase in history.

The GDP beat the expected forecast of a 32% increase.

The surge in growth was mostly driven by personal spending, which climbed an annualized 40.7%, also a record, while business investment and housing also posted strong increases.

Looking at the data breakdown, the Q3 increase in real GDP reflected increases in consumer spending, inventory investment, exports, business investment, and housing investment that were partially offset by a decrease in government spending. Imports, which is subtracted in the calculation of GDP (GDP = C + I + G [X – M]) , increased.

The increase in consumer spending reflected increases in services (led by health care) and goods (led by motor vehicles and parts).

The increase in inventory investment reflected an increase in retail trade inventories (led by motor vehicle dealers). The decrease in government spending was in federal as well as state and local government.

However, not all news was good. As Bloomberg reports, despite the positive report, analysts caution that growth will be much more modest and choppy in the months to come, especially as the second wave of the virus gathers pace and lawmakers remain in an extended deadlock over a new stimulus package. Additionally, there are still nearly 11 million fewer workers on payrolls than there were before the pandemic hit, and analysts say a full recovery in GDP is at least several quarters away.

Also, information that got lesser light was real disposable personal income (DPI) [personal income adjusted for taxes and inflation], decreased by 16.3% in the third quarter after increasing 46.6% in the second quarter.

Personal saving as a percent of DPI was 15.8 percent in the third quarter, compared with 25.7 percent in the second quarter (less money saved as large amounts of people are still unemployed).

Also, the prices of goods and services purchased by U.S. residents increased 3.4 percent in the third quarter of 2020, after decreasing 1.4 percent in the second quarter. Food prices decreased 1.8 percent in the third quarter, while energy prices increased 27.8 percent.

What happens next? Well, that largely depends on whether any further stimulus gets passed in Washington.

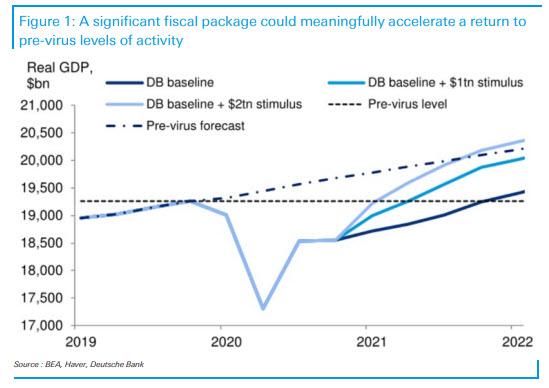

Deutsche Bank analyzes potential outcomes in the chart below. There are various scenarios where the US economy will likely head with various fiscal stimulus estimates relative to the pre-virus forecast. The chart includes a baseline, baseline + $1 trn, and baseline + $2 trn.

The size of stimulus will likely vary by party, as Biden is likely to agree to a total package of around $2tn, which is expected to get the economy close to the pre-virus trend towards the end of 2021. The $2.5tn of Biden tax rises are assumed to be delayed until early 2022, when the economy is on stronger footing.

Some good news regardless if it has been priced in or not !

Works Cited:

https://www.zerohedge.com/markets/us-gdp-soars-record-331-q3-smashing-expectations